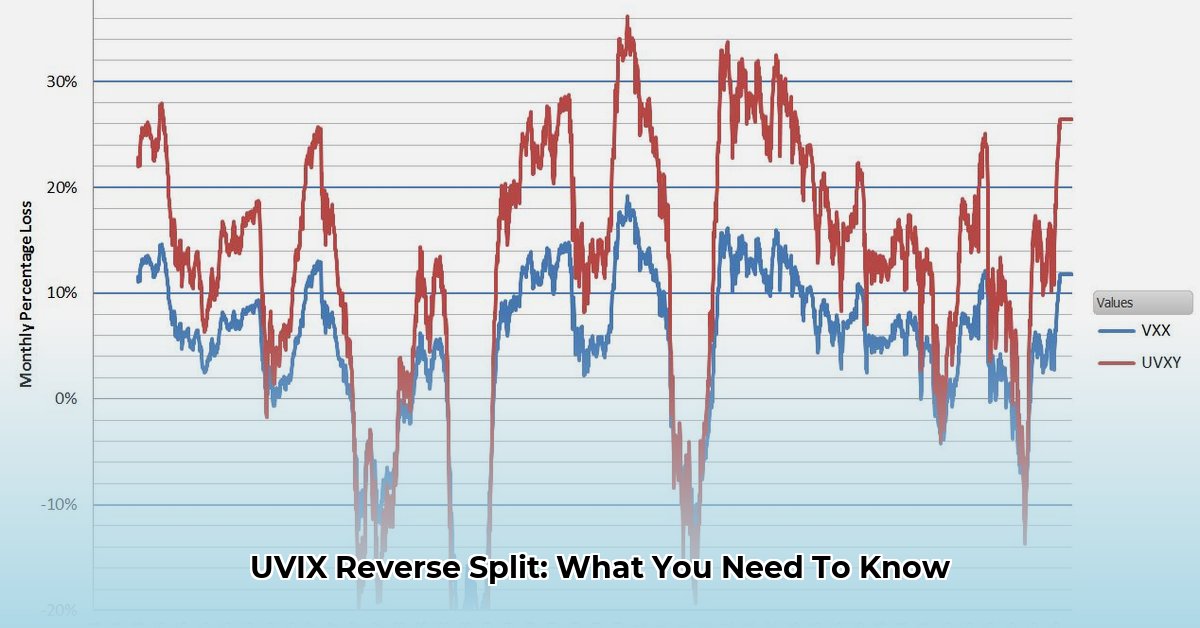

UVIX, the exchange-traded fund (ETF) that aims to double the daily moves of the VIX (the "fear gauge" of market volatility), is known for its dramatic price swings. Understanding how UVIX reverse splits impact your investments is crucial for managing risk and potentially capitalizing on opportunities. This guide provides actionable steps, a risk assessment, and advice tailored to different investor profiles.

Understanding UVIX Reverse Splits

A reverse stock split combines your existing shares into fewer, higher-valued shares. For example, a 10-to-1 reverse split transforms 10 shares into one, increasing the share price tenfold while maintaining your overall investment value (excluding brokerage fees). While seemingly simple, this significantly alters the trading landscape for UVIX, impacting its price volatility and liquidity.

How Reverse Splits Affect Different Investors

The impact of a UVIX reverse split varies significantly depending on your investment strategy:

Long-Term Investors: The reverse split itself doesn't directly affect your total investment value. However, the inherent volatility of UVIX remains a significant risk. Brokerage fees associated with the split should be considered, and diversification across various asset classes is essential to mitigate overall portfolio risk.

Short-Term Traders: UVIX's volatility, amplified by reverse splits, creates a highly risky environment. The increased price volatility and potential widening of the bid-ask spread (the difference between buying and selling prices) can lead to significant transaction costs and difficulty in timely trades. Short-term trading in UVIX requires advanced skills and considerable risk tolerance. Is this level of risk aligned with your investment goals?

Options Traders: Reverse splits pose significant challenges for options traders. Your options contracts must be adjusted, potentially causing delays and complications in trading. This can lead to difficulty in obtaining accurate pricing and managing hedging strategies. The risk of margin calls (where your broker demands additional funds to cover potential losses) is also heightened. Therefore, consistent communication with your broker before and after a split is paramount.

Actionable Steps: Preparing for a UVIX Reverse Split

Here's a step-by-step guide to navigate a UVIX reverse split effectively:

Stay Informed: Actively monitor your brokerage account and relevant news sources for announcements regarding potential reverse splits. Proactive monitoring helps you prepare strategically.

Assess Brokerage Fees: Inquire about any fees your broker charges for reverse splits. These fees can eat into your profits, so understanding them beforehand is critical.

Review Investment Strategy: Re-evaluate your investment strategy in light of the reverse split. Does your risk tolerance remain aligned with the inherent volatility of UVIX after the split? Honesty in this assessment is paramount.

Diversify Your Portfolio: Ensure your investments are diversified across different asset classes to reduce risk. Over-reliance on a single, volatile investment like UVIX is a recipe for potential significant losses.

Communicate with Your Broker: Especially crucial for options traders, this ensures clear understanding of contract adjustments and available trading options following the split.

Consult a Tax Professional: Although usually minimal, understand the tax implications of a reverse split to avoid any unpleasant surprises.

Risk Assessment Matrix: Navigating the Volatility

The following matrix highlights the key risks associated with UVIX and reverse splits:

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Extreme Price Swings | Very High | Very High | Diversification, position sizing, avoid leverage |

| Trading Disruptions | High | Medium | Pre-split planning, communication with broker |

| Margin Calls (Options) | High | Very High | Robust hedging strategies, conservative leverage use |

| Unexpected Brokerage Fees | Medium | Low | Transparent broker selection, fee comparison |

Conclusion: A Cautious Approach to UVIX

UVIX trading involves substantial risk. While reverse splits present specific challenges, proactive planning and risk management are essential to mitigate potential losses and potentially profit from opportunities. Consult a financial advisor before making any investment decisions related to UVIX. Remember that market volatility remains unpredictable, and losses are a possibility. Continuous monitoring and the ability to adapt your strategy are key to success in this variable market.